It is designed for small business owners without an accounting background. With just a couple of clicks and by filling out simple forms, you can create and send invoices, track expenses, manage projects and clients and view program evaluation reports. Most steps offer step-by-step guidance so you always know what to do next. Besides its primary plans, it also offers a custom plan with custom pricing for businesses with complex needs or large client bases.

Cloud Security

Cloud computing is a term that has gained widespread use over the last few years. The solution to this problem is one that has been around for nearly as long as the internet, but that has only recently gained widespread application for businesses. Discover the top 12 benefits of cloud computing, including how Salesforce Einstein 1 Platform can enhance scalability, reduce costs, and increase security for your business.

Why You Should Trust Us: How We Chose the Best Personal Finance Software

“At its core, NetSuite offers accounting functionality that is extremely robust and powerful. The flexibility afforded by its general ledger and ability to handle complex revenue recognition scenarios has served clients well across many different industries. AccountEdge provides a meticulously crafted suite tailored to small businesses. Grounded on the desktop, it offers a suite of command centers addressing various facets of your business, from sales and invoicing to payroll, accounting and inventory.

Archera helps customers access deep cloud discounts

Cloud accounting software, also known as online accounting software, is accounting software that helps you maintain your books of accounts online. Cloud accounting software such as QuickBooks is based in the cloud instead of being installed on your desktop computer. It allows small business owners to access their financial data including records of income, invoices, expenses, reports, inventory and more from almost any device because it is stored in the cloud via servers, instead of the user’s device. The downside to the free software is the fact it is not as robust as many of its competitors in the cloud accounting software space.

Time tracking is essential for many activities, such as paying hourly employees and charging clients on a per hour basis. Cloud accounting software should include native time tracking capabilities as well as integration with popular time tracking services like Clockify and Harvest. Besides pricing, there are many different features to consider when trying to decide on the best cloud accounting software for your needs. However, there’s no option to attach documents to transactions to share them with your accountant, so you’ll have to use your email or phone to send documents. This may not be a big deal for businesses that manage minimal transactions daily.

QuickBooks uses advanced, industry-recognized security safeguards to keep all your accounting data secure, private, and protected in the cloud. With QuickBooks Online Advanced, you can also restore a version of your company data based on a chosen date and time. Working in the cloud allows you to complete your accounting tasks efficiently—exactly when it’s most convenient for you. To determine the best accounting software, we meticulously evaluated numerous providers across specific categories.

"We're deeply sorry for the impact that we've caused to customers, to travellers, to anyone affected by this, including our companies," he said. A massive tech failure has caused travel chaos around the world, with banking and healthcare services also badly hit. All this seems to indicate that given the apparent direction in which the industry is moving, there’s never been a better time to get your head in the cloud.

Intuit QuickBooks has a 4.3-star rating and a 4.4-star rating on Capterra and G2, respectively, with over 6,700 reviews on the two platforms. Users say the software is comprehensive in its accounting features and easy to use. However, they say that solving an issue can be time-consuming and frustrating. While we found NetSuite offers advanced tools and capabilities beyond many cheaper alternatives, the UI can be quite busy and might require some time to navigate effectively. Additionally, business owners may need to engage a consultant to leverage NetSuite’s extensive features fully.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Easy to use, well-designed, and deep, Quickbooks Online will equip you with the most effective accounting tools while being uninhibited by internet speed and cost effectiveness. Also, if you invite users to view your data, you can control the levels of access as a much safer method than the old-fashioned email sending and USB storing. Being one of the most secure ways to store information, cloud security encrypts your financial data online on highly secure servers.

However, it doesn’t offer time tracking of payroll features, creating fewer efficiencies than some competitors provide. QuickBooks Online is known for its robust feature set, including key features, like project management, inventory accounting—and this makes it our overall best small business accounting software. However, on top of its extensive feature set, QuickBooks Online is ideal for small business cloud accounting because it allows you to invite your bookkeeper as an accountant user easily without counting toward your paid users. FreshBooks is an intuitive, easy-to-use accounting software designed for small business owners who do not have an accounting background. It allows users to easily create invoices, manage projects, track expenses, track time, track loans and file taxes. For example, I can easily add a project by filling out a simple form, then access the project’s financial reporting and cost/income tracking from the left-hand “projects” menu tab.

You can also give your accountant access to the software, so they can access your numbers anytime they need to. With an online accounting program, you also have control over how much access to financial information can give to an employee. For example, if you have any employee processing payroll, you can give them access just to payroll without them being able to access bank accounts or financial information. Although it has the lowest starting price, at $12 per month, it can be a little more difficult to navigate than QuickBooks or FreshBooks.

- If you’re looking for an accountant who specializes in Xero, you can search for an accounting advisor through their website by location and industry.

- Access your business finances from any internet connected laptop, smartphone or tablet.

- Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager.

- Cloud accounting is a system that allows multi-user access and safe online or remote server storage.

In the world of bookkeeping, efficiency and accuracy are critical to success. For Laura and her team, MYOB business management solutions have been instrumental in driving these core values. Whether your personal finance software is secure will depend fdic law regulations related acts on what personal finance software you use. If you're concerned about security, make sure to carefully read over the software's terms of service and security policies to see what it does with your financial information and how it protects it.

Zoho Books is the cloud-based accounting component of a larger suite of business solution tools. In addition to accounting software, Zoho offers more than 40 enterprise-level online applications to grow sales, preferred stocks that pay high dividends market your business, communicate with teammates, provide customer service and more. Businesses that need an integrated business ecosystem will have a hard time finding a more robust business suite.

Legal and trust accounting software is the best way for small to mid-sized law firms to comply with rules that many legal jurisdictions have regarding funds held in trust on behalf of a legal client. Payments are due by the end of your monthly billing period based on the date you purchased your subscription. See all your invoices, contacts, balances, financial information and accounts online. Tag things as you work to track events, projects, locations, and anything that matters. Run custom reports based on your tags for an instant view of insights that matter most to you. See how you can track and manage your whole financial picture in one place—from bank transactions, expenses, and beyond.

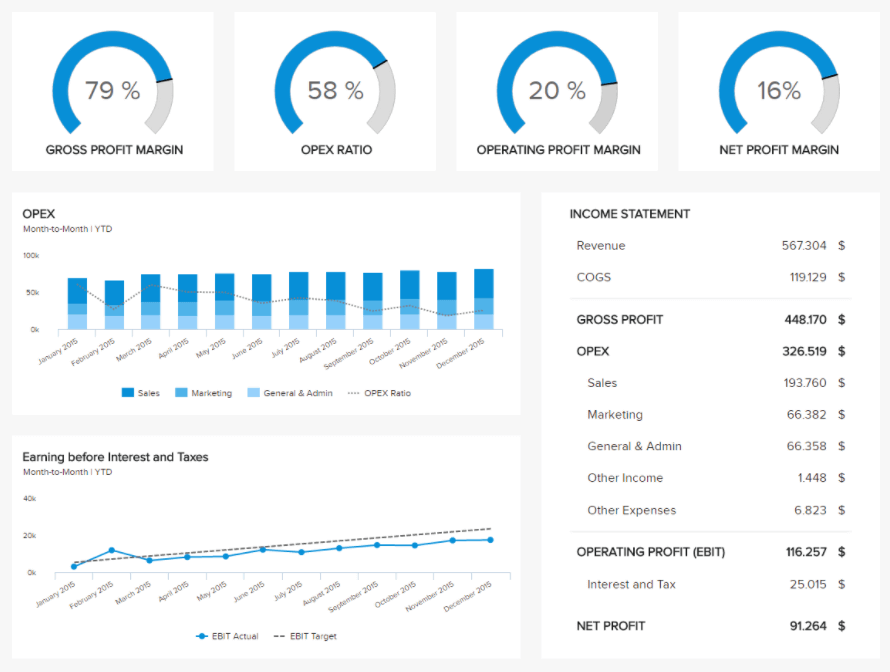

This holistic approach to business oversight enables Laura to identify opportunities for growth and areas for improvement, ensuring that her practice continues to excel. “One good thing about the MYOB product is the MYOB Advisory tool – with all the pretty graphics – it just makes it so much easier to get the data you need right away without having to go digging for it,” says Laura. Having the right software to power this business model is something she knew she wasn’t willing to compromise on. Quicken Deluxe also has a "what-if" tool that lets you see potential scenarios when you make certain investments or loan decisions to help you build a financial plan. Personal finance software can be a great tool for building better money habits and learning how to budget in the long term.